Afterwind – Revolutionary Recycling of Wind Turbines: Part 2

Wind energy is crucial to transforming the world into a greener one. A missing piece is the lack of recycling: Wind turbine blades can barely be recycled because they consist of a tough composite material. Research indicates that there will be 43 million tonnes of blade waste worldwide by 2050, imposing a significant risk of pollution if not handled appropriately.

The Norwegian Startup Afterwind is tackling this problem, having developed a revolutionary process of recycling old wind turbine blades into virgin-grade material that can be used for new wind turbine blades. Together with the team that includes Zeib Khwaja from London Business School, they have won this year’s Turner MIINT competition of Wharton Business School on Impact Investing.

In our latest interview with Afterwinds CTO Henrik Selstam, we learned about the idea of Afterwind. Today, we will learn why Afterwind is an attractive case from the point of view of #impactinvesting.

What is impact investing? Impact investing is the concept of unleashing capital towards businesses that are creating a positive influence on the planet, and its people. These investments are made with the intention to generate positive, measurable social and environmental impact alongside a financial return.

– Zeib Khwaja

In the first part, we are talking to this year’s winner of the Turner MIINT competition, Zeib Khwaja:

Who are You?

My name is Zeib Khwaja and I am currently doing an Executive MBA with London Business School, and this is alongside me working full-time for JP Morgan Chase. I want to help businesses make profits with purpose.

The Turner MIINT Competition

At Wharton Business School, the ESG department offers an experiential 6-month program in impact investing. Upon enrollment, participants dive into a dynamic learning environment where theoretical knowledge meets real-world application. For me, this journey marked a pivotal moment, shifting my focus from mere profit to meaningful environmental stewardship. With a lifelong passion for social service, the course provided an avenue to merge personal values with professional ambition.

Throughout the program, participants are tasked with navigating the intricate landscape of impact investing akin to venture capitalists. From crafting investment thesis to meticulously screening potential companies, every step is imbued with the dual purpose of financial viability and positive societal impact. Key milestones include evaluating founding teams for credibility, conducting due diligence to assess market potential and impact metrics, and ultimately pitching investment opportunities to venture capitalists.

The culmination of this experiential learning journey lies in presenting a compelling investment case to an esteemed investment committee. Here, comprehensive due diligence, risk assessment, and a cohesive team narrative converge to secure tangible investment commitments. It’s not just about securing a deal; it’s about championing ventures that embody both profit potential and transformative social change. This immersive experience equips participants with the acumen and confidence to navigate the intricate world of impact investing with purpose and proficiency. The best investment deal wins a $ 50,000 investment in the business. This year it was Afterwind, the company we sourced and presented.

Why did Afterwind Win?

Our investment thesis centered on identifying a company within the energy sector, specifically in renewable energy, that possessed both technological superiority and a focus on the EU market. Additionally, we aimed to prioritize teams with female representation among their founders.

In our search, Afterwind emerged as a standout candidate. Their innovation in recycling wind turbine blades to create new ones addressed a significant industry challenge that few had successfully tackled. While many companies recycle blades into alternative products, Afterwind’s approach of creating new blades stood out as groundbreaking.

Furthermore, our assessment of major wind farm owners revealed a growing interest and investment in blade recycling solutions, affirming the market traction for Afterwind’s proposition.

The founding team’s track record was equally impressive, boasting over 10 successful exits and extensive experience in recycling and waste management. Two of the founders exited Quantafuel at 1 Billion Euro Valuation. Their deep industry knowledge, coupled with established connections in the energy and renewables sectors, instilled confidence in their ability to execute their vision.

From a business standpoint, Afterwind demonstrated robust pricing strategies, a strong business model, and a commitment to sustainability. Their dedication to utilizing renewable energy for recycling and implementing transparent supply chain practices reflected a strong sense of responsibility and integrity.

Customer response to Afterwind’s offerings was overwhelmingly positive, with promising deals in the pipeline and revenue projections for the current year—an impressive feat for an industrial venture.

Moreover, Afterwind’s proactive approach to intellectual property protection through patent filings underscored their commitment to innovation and long-term growth.

How would you summarize your experience of being part of the Wharton MIINT Competition? This program has been an absolute game-changer! Collaborating closely with faculty from Wharton and London Business School, and diving deep into Afterwind, has been incredibly rewarding. Months of hard work paid off when we clinched the trophy! Connecting with like-minded students, impact investors, and alumni who share our passion for ‘Impact’ has been inspiring. Thanks to this course, I’ve expanded my network significantly. Impact Investing isn’t just a career choice—it’s a chance to make a meaningful difference in the world. This is where I belong, and where I’m determined to leave my mark

– Zeib Khwaja on the Turner MIINT competition

Currently, Afterwind has a Lead Investor PURE PLANET [Just Green Capital]. We are talking to their CEO, Sune Bertelsen, who is going to tell us why Afterwind is an attractive investment for Pure Planet:

Who are You?

My name is Sune Bertelsen. I am a Positive Human & CEO of PURE PLANET [Just Green Capital] an Impact Investment & Advisory firm headquartered in London. I was born in Denmark, and as an entrepreneur, I have had the opportunity to work globally for twenty years, serving people and the planet. I have lived in Moscow and New York, but most of my time has been spent in Europe.

What is the Vision of Pure Planet?

Pure Planet is just green capital. That’s our purpose and what we do – just means that what we do must to be fair for people and life on planet Earth. And it needs to be kept simple: We need to clearly understand the impact of the companies that we partner with, so we can communicate in a language that is honest and understandable to our co-investors and key stakeholders, including the customers buying the final products. It is crucial that it sells – both the story and the products because only then does the impact become sustainable.

We exclusively collaborate with greentech companies. Our reach is global and sector agnostic, meaning we are involved in areas such as energy, food & agriculture, mobility – the list goes on. We are thematically care about the impact created within any industry. The companies we engage with have high moral standards and values that align with those of Pure Planet. Before any deep dive and due diligence, we ask the question: How do you benefit life on Earth and our air, water, and land? If a clear impact is not evident or understandable, we do not move the relationship forward.

Our approach is impact-first without compromising on financial returns. This is achievable because we have a clear purpose and an impact investment strategy that steers us towards selecting only a few new investment opportunities each year from a global pool of remarkable greentech companies. We are not like large corporations compelled to cater to all client types and markets that requires a long transition journey. The most challenging aspect of our job is having to turn down exceptional entrepreneurs who have leading innovations with great impact potential.

There exists a funding gap for physical products that become industrial. While there is good support for early-stage ideas, investors often shy away from investing in building scale-up projects and plants due to the associated risk profile. This is where we step in. We do not sell ESG; rather, we engage in impact investment and provide services centered around investment opportunities that are guaranteed to be green. So, Pure Planet literally move money towards green innovation at scale every day we go to work, and in return, our portfolio of greentech companies delivers our purpose of Just Green Capital. This is the very reason for our existence.

Why did You Invest in Afterwind?

Afterwind is a clean-cut investment case for Pure Planet, due to the team’s experience and the scale at which they are solving a significant circularity problem in green energy. The company has a great business model.

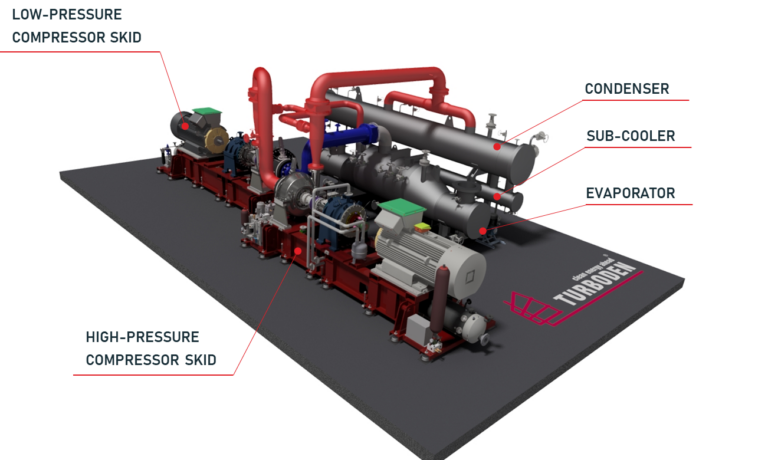

Afterwind focuses on moving wind energy, which is in transition, to become a fully circular economy by addressing one of the final missing pieces: the recycling of wind turbine blades. This solution benefits asset owners, manufacturers and assemblers of blades, who want to do better but now also have an urgent need due to EU regulatory requirements kicking in 2025. The process involves picking up the blade, addressing the need for healthy and sustainable recycling, and then, on the other end, offering the next generation of recycled virgin-grad materials that can go into the production of new blades. There is strong customer demand for recycled blades, and the largest glass fibre and resin producers are willing to pay.

The story, impact, and business potential of Afterwind is attractive to a broad group of investors, as well as the biggest energy producers in the world. It is considered a great investment opportunity, especially when considering the successful track record of the team. The team previously founded Quantafuel, a company focused on transforming plastic into fuel, which achieved a billion-dollar exit. They also established Wastefront, a company that recycles tyres at scale. Afterwind will generate revenue starting from this year. The company’s approach involves purchasing existing machines, improving processes, and enhancing the quality of the end product. With their successful track record in scaling businesses, there is lower technology and operational risk at this early stage compared to industry standards. This makes Afterwind a compelling investment opportunity.

We knew why this business, why we started it and there was this vision of strategic long-term impact. And then opportunistically, we knew that we could do it. We can technically solve a challenge fast, which means we are moving quickly through the startup phases in order to get us operational.

– Julia Minici, Co-Founder and Senior Business Advisor at Afterwind

Whom to Contact?

Are you feeling inspired by this exciting idea and eager to explore more? Reach out to Zeib or Sune for a delightful discussion, or simply visit Pureplanet and Afterwind to learn more about their work.

Have a look at our previous interview with Afterwinds CTO Henrik.